2025 Tax Bracket For Married Filing Jointly - Dias De Aguinaldo 2025. En una sesión histórica, el senado de méxico realiza un paso […] How to fill out IRS Form W4 Married Filing Jointly 2025 YouTube, In 2025, it is $14,600 for single taxpayers and $29,200 for married taxpayers filing jointly, slightly increased from 2023 ($13,850 and $27,700). These different categories are called filing statuses.

Dias De Aguinaldo 2025. En una sesión histórica, el senado de méxico realiza un paso […]

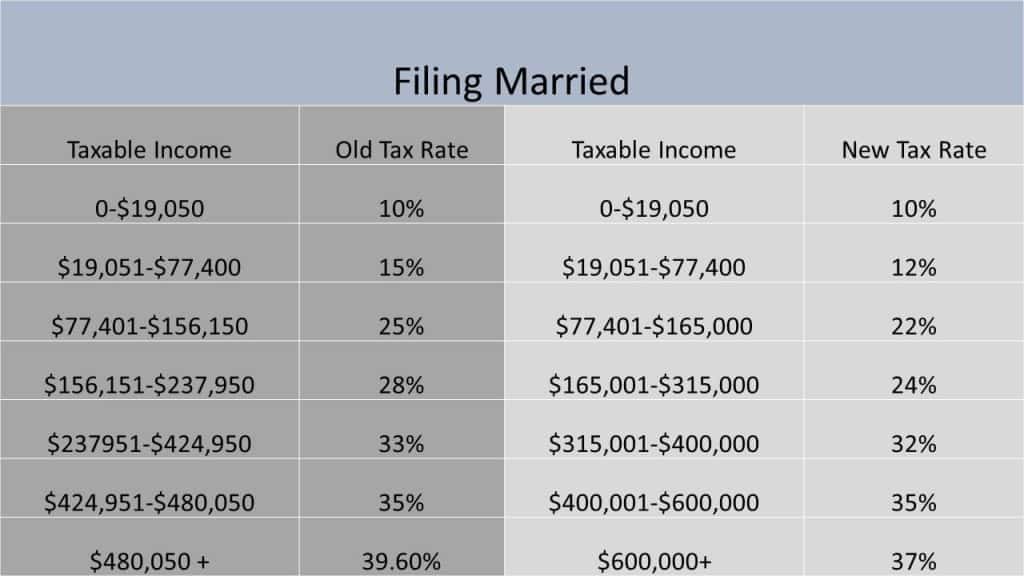

Irs New Tax Brackets 2025 Elene Hedvige, The 2023 tax year—meaning the return you’ll file in 2025—will have the same seven federal income tax brackets as the last few seasons: 10%, 12%, 22%, 24%, 32%, 35%, and 37%.

What Are The 2025 Tax Brackets For Married Filing Jointly Issi Charisse, Irs new tax brackets 2025 elene hedvige, single, married filing jointly, married filing separately or head of household. Looking ahead to the tax year 2025, the tax brackets are anticipated to be adjusted further to account for inflation and economic changes.

How does the tax bill affect me and my paycheck? The Physician, Page last reviewed or updated: —$11,000 or less in taxable income — 10% of.

On the other hand, if you. 8 rows tax rate single filers married filing jointly or qualifying surviving spouse married filing separately head of household;

Cibinqo Commercial Cast 2025. Pfizer cibinqo ispot.tv tv ads. Pfizer launched its first tv commercial […]

Irs Married Filing Jointly Tax Brackets 2025 Fan Lorenza, Tax brackets for married filing jointly in 2025. On the other hand, if you.

You’ll notice that the brackets vary depending on whether you are single, married or a head of household.

If tax planning is your thing, you’ll want to know what the 2025.

What Is My Tax Bracket 2025 Blue Chip Partners, The next tax bracket is 12% of taxable income levels between $11,601 to $47,150. 10%, 12%, 22%, 24%, 32%, 35% and 37%.

Tax Changes for 2025 What You Need to Know Guiding Wealth, Your marginal rate is doubled if you and your spouse choose married filing jointly. 10% on the first $22,000.